The challenge

Newcastle Building Society (NBS) has grown its mortgage assets significantly in recent years and has plans to continue. To prepare for this growth whilst cognisant of cost of living challenges, NBS engaged with Arum to complete an Excellence Assessment on the arrears management processes, paying particularly attention to achieving good outcomes for it’s members facing financial difficulty.

Following the assessment, Arum identified several opportunities for improvement, with a key focus on the rightsizing of a new Operating Model to ensure early and effective engagement of arrears customers, together with improved monitoring, management and control of customer outcomes by delivering and embedding a new robust Quality Assurance Framework and provision of Arum Good Outcome Training, both of which were aimed at driving up capability within the Mortgage Support team to ensure good customer outcomes.

The solution

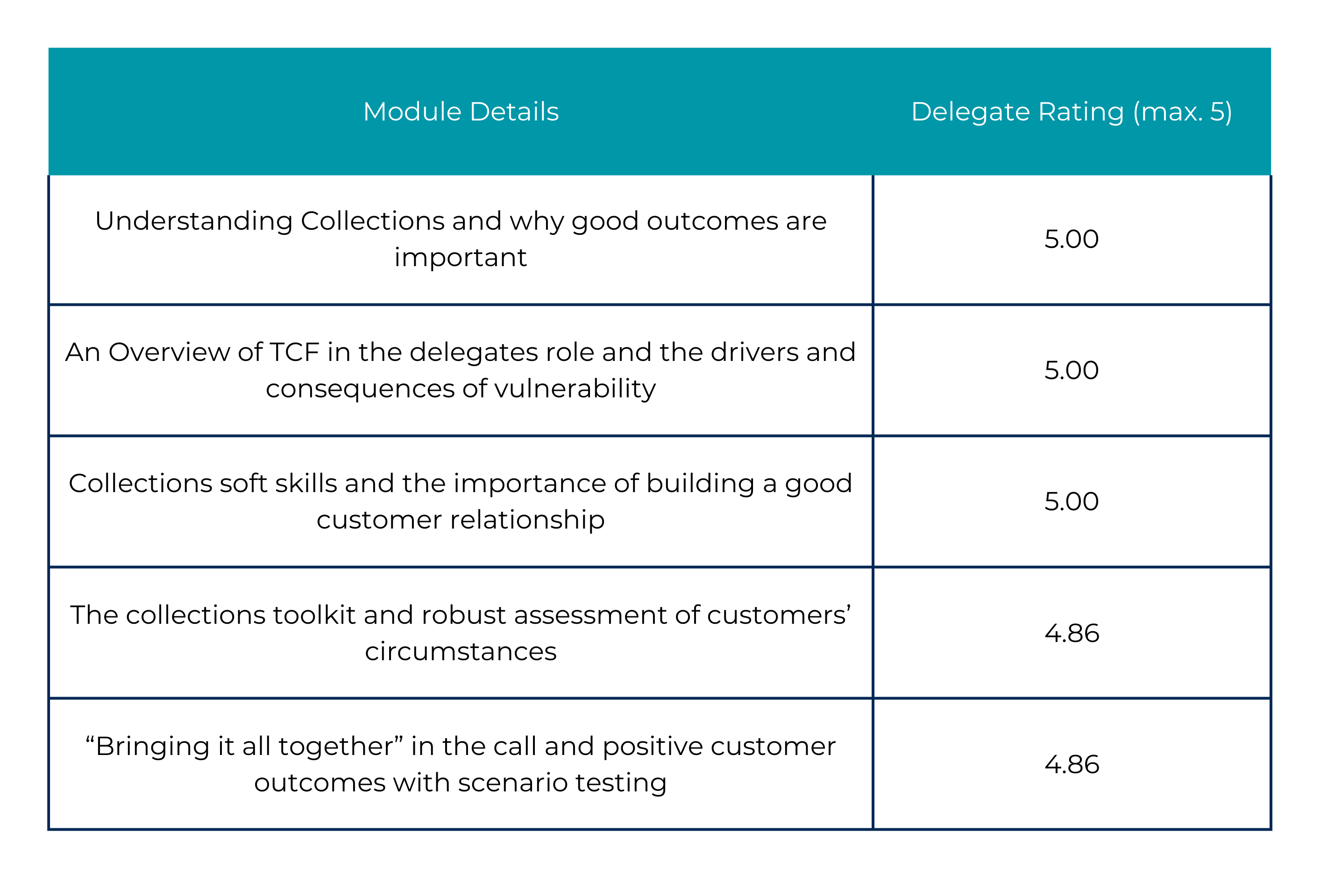

Well versed in the regulatory requirement of Treating Customers Fairly and the newly incepted Consumer Duty, that ensures good outcomes within a mortgage environment, we designed and deployed a new Mortgage Support Team Operating Model in NBS, a QA framework and delivered Arum’s 5 Modular “Good Outcomes Training” package to meet requirements that included:

The results

Following delivery of the new QA Framework, NBS observed an expected initial downward movement in the internal Quality Control oversight with only 77% of assessments achieving a pass rate as new processes were embedded. Through ongoing calibration, coaching and training interventions to enable colleagues to improve their ability to drive out good customer outcomes, NBS performance is now greater than 90% of assessments achieving a pass rate.

In addition, NBS is now consistently achieving above 70% of solutions agreed with customers continuing to perform after 3 months, a good indication that the assessment of a customer’s personal and financial situation is resulting in improved outcomes.